Domestic Content Bonus Guidance:

Key Updates

The IRS released Notice 2025-08 on January 16, 2025, providing updated guidance on the American Domestic Manufacturing Bonus tax credits for Clean Electricity Production and Investment Tax Credits. This update revises the safe harbor table, impacting how developers calculate bonus eligibility.

Takeaways:

- Domestic Modules Gain, Inverters & Racking Lose: The Safe Harbor Table significantly boosts incentives for domestic modules while reducing the contribution from inverters and racking.

- Racking Contribution Adjusted: Rails contribute 15% (MLPE) or 18.7% (string inverters), with structural fasteners at 3.5%, totaling a max of 19.6% from racking.

- MLPE Contributions: Fully domestic MLPEs contribute as much as 24.8%.

These changes impact solar manufacturers, developers, and installers evaluating domestic content compliance. As policies evolve, EcoFasten will continue providing trusted insights to navigate these updates.*

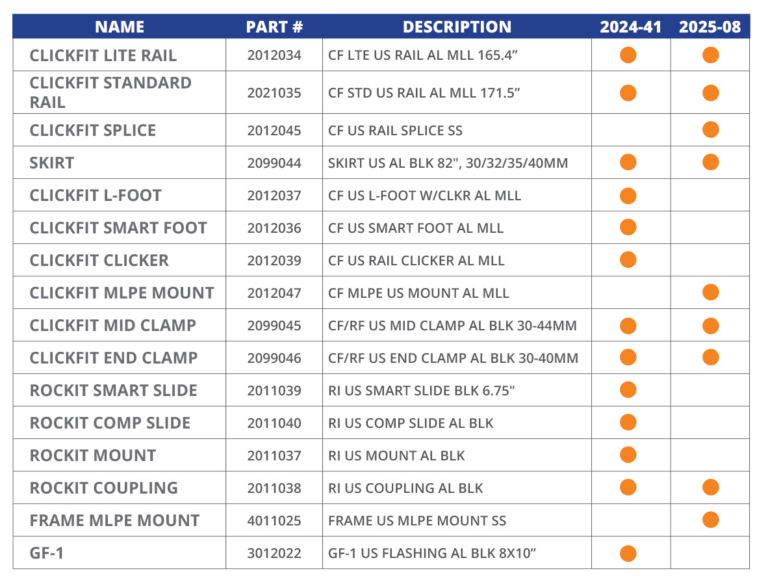

DOMESTIC CONTENT PART NUMBERS:

The chart below lists our DCBC-eligible parts and part numbers based on both the 2024-41 and 2025-08 guidance. Both remain applicable, depending on project timing, jurisdiction, or other qualifying factors, ensuring all eligible configurations are covere

Traceability Guidance

Our Domestic Content Traceability document provides guidance for identifying DCBC eligible parts through a variety of methods, including part numbers, packaging, documentation, and physical markings on the each US fabricated component.

Contact us today to discuss your project! We’re here to help you maximize your tax credits and ensure you’re ready for future requirements!

*DISCLAIMER: EcoFasten does not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only and is not intended to be relied upon in place of professional advice. You should consult your advisors before engaging in any transaction.

*Treasury guidance currently specifies 40% per the Adjusted Percentage Rule (APR). The PV system must satisfy the APR to qualify for the domestic content tax credit adder for the Investment Tax Credit (ITC) or Production Tax Credit (PTC). While the PTC specifies a 5% yearly increase in the APR (currently at 45% for 2025), the ITC’s language was not updated to reflect a similar escalation. Some view this as an oversight that may indicate a need for caution. Entities may view the needed percentage to qualify as 45%. Speak to your tax and legal counsel for guidance on your project(s) threshold.